Last year saw the impact of the Standardized Approach for Counterparty Credit Risk (SA-CCR) reach new heights

In January 2022, US and UK banks joined their Australian and Canadian counterparts, who have been operating under the regulatory regime longer. This resulted in an accelerated appetite to effectively optimize under this methodology. By addressing their exposures, banks reduced record amounts [1] of SA-CCR RWA on an interbank level. Further, it became evident SA-CCR RWA may at times be dominated by those originating from buy-side client exposures, leading to new conversations and explorations on how to optimize for an enhanced liquidity partnership [2].

At the same time, Uncleared Margin Rule (UMR) phase 6 took effect in September 2022, reducing the AANA thresholds from $50bn to $8bn, adding a large new universe of funds required to post and receive margin. This further increased the number of buy-side funds in-scope that needed to address processes for margining of uncleared derivatives. The increase was anticipated to be between 700 to 1,200 additional firms globally, a significantly larger number than the estimated 300 firms which were in-scope for Phase 5, according to the DTCC [3].

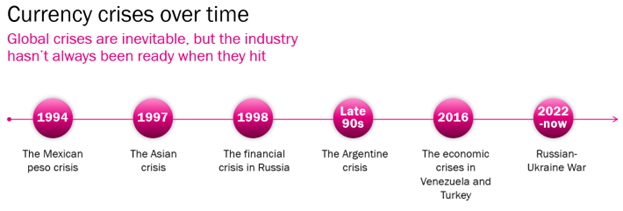

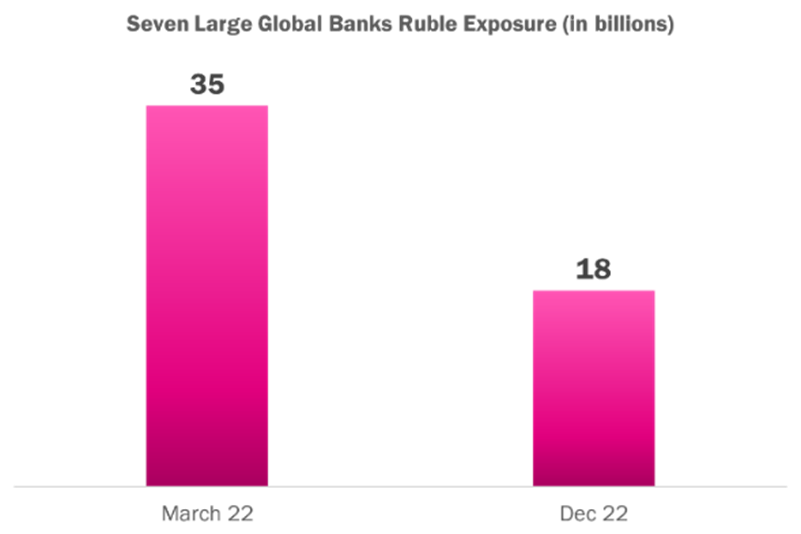

Additionally, the effect of higher interest rate levels with elevated FX volatility, increased uncertainties across Emerging Markets (EM) currencies and less stable economies, heightened the need to manage risks including settlement risk. The latest BIS quarterly review [4] quantifies that in April 2022 $2.2 trillion of daily FX turnover was subject to settlement risk compared to an estimated $1.9 trillion in April 2019, an increase in line with general turnover change. Further, the same review highlights that nearly a third of deliverable FX turnover is subject to settlement risk according to the 2022 BIS Triennial Survey. Current market conditions aside, the need to address risk management and post-trade processing is always critical from a best practice standpoint and included in the FX Global Code [5].

On the back of regulatory reforms is the increased need for data and automation. For example, we have seen buy-side execution desks adopting automated execution and transaction costs analysis (TCA) alongside MiFID II (Markets in Financial Instruments Directive). The financial industry trend of seeking increased transparency, analytics, and insights has entered the post trade capital and funding space. Buy-side execution desks, operations, and portfolio managers are being bridged closer and closer together as the benefits of efficient post-trade capital optimization can be added to the bottom line of aggregated risks and costs across portfolios. By accessing on demand metrics, such as EM settlement risk and RWA drag on counterparties, portfolio managers receive increased insights to mitigate risk.

Now, some managers are starting to explore the indirect effects of SA-CCR and how to jointly enhance the liquidity partnerships with their banks under the regime. Also, banks, not yet under SA-CCR, may benefit from joining this trend now to be ready when the time comes. This is positively affecting the cost of business across participants, with an opportunity to additionally address multiple utilities and constraints. For example, an asset manager having UCITS funds can benefit from gross notional reductions to reduce leverage while also addressing their counterparty’s need.

Expect an emergence of more asset managers seeing the direct benefits for their FX businesses and client services by adopting capital optimization solutions just as banks, and hedge funds, have done for years. The utilities are multi-fold and can include metrics such as reduction of gross notional, line items, counterparty concentration, limits, settlement risk, margin, and much more. Many portfolio managers have several constraints including non-comingling of funds, where block trades are allocated back to each individual fund or sub account. Hence, utilizing technology and automation is crucial to seamlessly optimize for a large number of funds, which could be in the order of hundreds or thousands. By leveraging technologies and services, users can simplify workflows, scale, and gain a competitive edge.

When reaching their bank counterparties on a single go-to platform, buy-side users receive not only consistent processes, but also simultaneous access to the full network of counterparties with bilateral and multilateral opportunity sets. Joining the client-to-dealer network has a scope far greater than one single utility or regulation. It allows liquidity partnerships to be manifested and glued together with technology for enhanced transparency and flexibility to quickly adapt to new emerging risks, regulations, and events of the future.

[1] https://www.marketsmedia.com/capitolis-completes-record-sa-ccr-optimization/

[2] https://capitolis.com/buysidetalkingtobanksaboutcapitalcosts/

[3] Ready or Not: What In-Scope Firms Should Be Doing to Prepare for Phase 6 of the Uncleared Margin Rules

[4] https://www.bis.org/publ/qtrpdf/r_qt2212.pdf, page 75-77, “FX settlement risk: an unsettled issue”

[5] https://www.globalfxc.org/fx_global_code.htm

Dr. Petra Wikstrom holds a PhD in Turbulence, Fluid Dynamics, from the Department of Mechanics at the Royal Institute of Technology (KTH) in Stockholm, Sweden, one of Europe’s leading technical and engineering universities.

Petra is currently a Business Development Executive with Capitolis. She is the former Global Head of Execution & Alpha Solutions within FXLM & Commodity Derivatives Sales and Trading at BNP Paribas in New York, NY. Previously she was the Head of QSI North America within FXEM Sales and Structuring at Morgan Stanley in New York, and the former Global Head Quant Solutions at RBS (now NatWest) in Greenwich, CT and London, England.

Written by

Dr. Petra Wikstrom