Foreign exchange (FX) is the backbone of global trade: trillions of dollars are exchanged daily across global markets. FX settlement transactions are key to a functioning global financial system.

They also carry an inherent settlement risk. This can result in significant losses and high costs for market participants – and can lead to systemic consequences, too. Market participants are exposed to FX settlement risk every day: almost a third of deliverable FX turnover, or $2.2 trillion, was still at risk on any given day in April 2022 as it was not covered under Payment-versus-Payment (PvP).

Addressing this risk is essential for safeguarding the stability of the global economy. Market participants can turn to technology-driven tools, like settlement optimization services, to help reduce settlement risk and prepare to mitigate a potential problem—before it arises.

Drivers of Settlement Risk

Years ago, central banks devised a system wherein commercial banks would exchange currencies through a financial market utility (FMU), which are “multilateral systems that provide the essential infrastructure for transferring, clearing, and settling payments, securities, and other financial transactions among financial institutions or between financial institutions and within those systems.”

However, not all principal exchanges are covered on an FMU, including many currencies (e.g., Russian Ruble, Turkish Lira, Chinese Yuan), and therefore they are inherently exposed to higher settlement risk. In addition, when a country is in crisis, settlement risk is magnified by a greater likelihood of failure. Geopolitical risks, such as sanctions or political upheavals, will further exacerbate currency volatility, and increase settlement uncertainty.

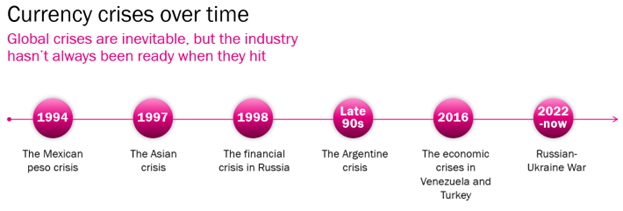

There have been seven major currency crises in the last 30 years. Most recently, we’ve seen a crisis with the Russian Ruble, where banks were overexposed to the currency and unprepared for the risk of Russia’s sudden invasion of Ukraine in 2022, which led to global sanctions and the devaluing of the Ruble.

A currency crisis is an unfortunate inevitability over a banking lifetime and can be crippling if banks are not prepared to handle the associated settlement risk.

Two Types of Viable Solutions to Mitigate Settlement Risk

- Payment vs. Payment Transactions: The most common and effective present day FMU is a Continuous Linked Settlement (CLS), an international payment system launched in September 2002 to handle FX transactions. This utility offers banks and market participants real-time gross settlement to provide protection in the over-the-counter (OTC) FX markets. The CLS operates within a specific window of time each day, during which all commercial banks can exchange currencies on a simultaneous basis. This Payment vs. Payment (PvP) process ensures that both sides of a transaction are settled simultaneously, minimizing the risk of one party defaulting before the other side settles. While CLS has provided solutions for stable currencies, it is important to note that more volatile currencies are not so easily settled through a PvP process.

- Optimization Services: If a currency isn’t covered on an FMU, or when a global crisis occurs and a currency is extremely volatile, the traditional CLS to facilitate a PvP transaction may not be a feasible risk-mitigation option. Instead, financial institutions can leverage a settlement optimization service – a technology solution that works to reduce every party’s settlement exposure in advance and avoid needing to settle any unnecessary PvP transactions. This method optimizes currency exposure by moving positions across participating banks and optimizing each pair simultaneously. In addition, the service enables financial institutions to reduce gross notional and line items to simplify their books, so they can more easily handle a sudden currency shock or crisis. In the same way one purchases a home insurance policy ahead of something happening to their home (e.g., a tree falling on it), a settlement optimization service looks to reduce exposure ahead of time, providing a unique and vital service by addressing potential settlement risks before they escalate. This creates an added layer of protection for the global banking system.

There are two types of optimization services – Bilateral Day of Settlement Netting and Multilateral Future Settlement Optimization.

Bilateral Day of Settlement Netting: A bilateral mechanism that allows for the offsetting of payment obligations between a pair of participants across multiple currencies the day the trades are due for settlement. The benefit of this service is operational risk reduction and operational efficiency.

Multilateral Future Settlement Optimization: Facilitated as a run with multiple participants looking to optimize for future settlement, this mechanism moves positions across network participants. The benefit of this service is future risk reduction while also allowing participants to reduce gross notional and line items to simplify books.

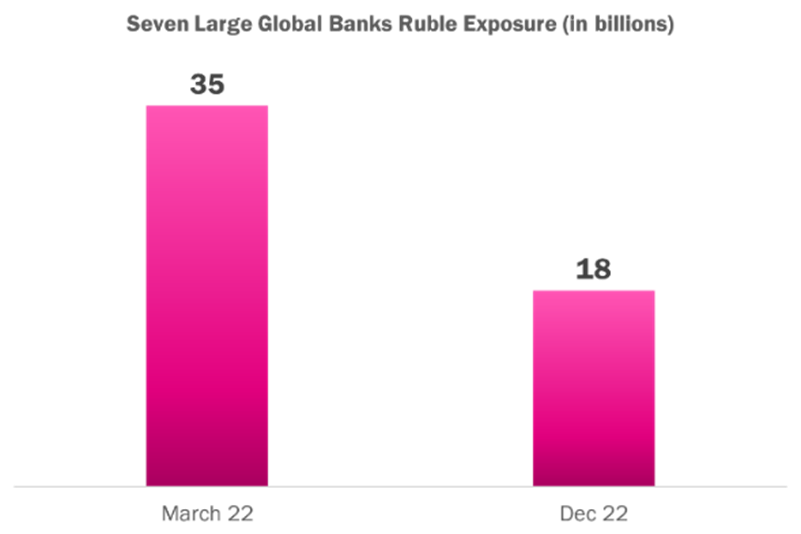

A case of leveraging Settlement Optimization to reduce volatile currency exposure just occurred via the Russian invasion of Ukraine. At the start of the crisis, many banks had large exposures to the Ruble, which became extremely volatile given sanctions, deflation of the currency, and growing uncertainty regarding what impact the war would have on the Russian economy. These banks had an immediate need to reduce their Ruble exposures. They only had a few means to do this: stop trading, roll off trades, and/or actively optimize their portfolios.

Using data from seven large global banks at the start of the Russian invasion of Ukraine through the end of the year proves the effectiveness of those means. Between March 2022 and December 2022, the aggregated exposure of those seven banks was nearly halved: from $35 billion to $18 billion.

We Must Be Prepared for Settlement Risk

In a world where trillions of dollars are exchanged daily across global markets, settlement transactions are the lifeblood of banking and as such carry monumental risks. If not accounted for, a single point of failure can trigger a cascading effect, disrupting the entire financial system. Market participants now have the tools to mitigate these risks and ensure the stability of the global economy.

Kate Weston is Head of Execution, Portfolio Optimization for Capitolis, the financial technology company creating safer and more vibrant capital markets.